If you haven’t already partnered with a large OTA (Online Travel Agent) like expedia.com, booking.com, or airbnb.com chances are you’re thinking about it. With Expedia purchasing HomeAway in 2015 for $3.9B, the last couple of years have been a game changer for many in the vacation rental industry.

Up until recently, it was conventionally accepted wisdom that HomeAway and VRBO provided the best “bang for your buck” to maximize ROI on marketing dollars spent.

The efficiency in drawing a large volume of bookings provided by these online marketplace websites caused most property management companies to be singularly focused on this marketing channel while completely ignoring the importance of an “owned channel.”

Thus, year after year, most vacation rental websites were grossly neglected, as owners didn’t understand the value of creating their own organic traffic and bookings.

But therein lies the problem with singularly and totally relying on third-party sites to facilitate and manage the booking process: properties are beholden to the whims of those third-party businesses. When there’s a merger or buyout, like in the case of Expedia/Home Away, it’s not one of those businesses that suffer in the ensuing shakeup-it’s yours.

Or when one of those third-party sites decides to adjust its business model, guess who’s left scrambling to adjust their marketing budgets to make up the difference?

For example, when Facebook introduced a “pay for play” scheme on business posts, businesses that had sunk hundreds or thousands of man hours developing communities around their business pages were left holding the bag, forced to either pay up to engage with followers they used to do so for free, or no longer engage with them at all.

Likewise, when Expedia purchased HomeAway, they did so already knowing the potential revenue they could generate by changing from a paid listing to a percent-per-booking model.

They also knew how much HomeAway’s members relied on the channel for bookings, meaning that while they would surely expect some grumbling from affected properties, they also could expect that few could afford to ditch the service, even with the additional cost.

Understanding the Difference of Hotel OTA’s and Vacation Rental OTA’s

Hotel OTA’s, like booking.com, collect commissions on gross nightly rates. If you charge $100 per night, they get typically 15 – 25%, or $15 – $25 per night booked, leaving just $75 – $85 to the owner and property manager.

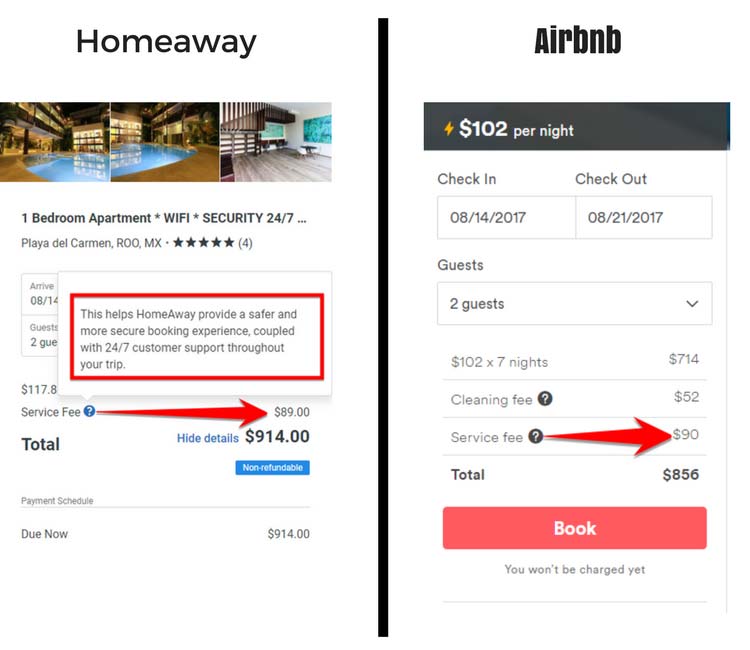

Vacation Rental OTA’s, like AirBnB and HomeAway, charge the guest by adding a booking fee. A property that costs $100 per night now costs the traveler $105 – $112 per night with the booking fee.

Property managers typically make the highest profits when bookings occur on their property’s own site. Receiving a booking through a hotel OTA, like expedia.com, typically equates to zero profits for the property manager after paying the high fees associated. Receiving a booking through a vacation rental OTA, like airbnb.com (and now homeaway.com), the guest pays un-necessary booking fees, causing considerable pricing confusion for customers that may simply be turned off by reading one advertised price while being expected to pay another.

Few property managers have figured out methods to achieve profits through hotel OTA’s, but this takes money out of the property owner’s pocket. Either way, counting on this booking method for the majority of bookings is not sustainable to maximize profits.

Quote from Searchmetrics 2017 Travel Ranking Factors

“The big gorillas are the major OTAs. Yet, their combined market share is expected to reach only 41% in 2020, according to a projection by Phocuswright. This leaves plenty of space for rival price comparison, travel review and other industry sites, as well as the direct providers of travel services like car rental companies and hotel chains. To play a meaningful role online, these websites have to make themselves found on search engines like Google, which means knowing what distinguishes the best-performing URLs from those on Google’s 2nd and 3rd pages. And they must learn how to tailor content to be relevant for users searching for travel-related keywords.”

Understanding How the Property Manager Gets Paid

The percentage property manager’s take can vary greatly, but most property management companies collect 25 – 45% revenue share for each booking. This may seem like a substantial amount from where the property owner stands, but efficient marketing and on-site operations require extensive, expensive, and time-consuming work on the part of property manger.

Property management companies charging lower level revenue splits of 25 – 30% would be giving up nearly 100% for booking generated through a hotel OTA. For those companies collecting 35 – 45% (or more) are required to give up 50% or more.

Some property managers get away with passing this fee to the owner as an additional marketing cost, which raises the revenue share greatly in favor of the property manager but escalates dissatisfaction of the owner, for obvious reasons.

An Owned Channel Means Relying Less on OTAs (and Taking Home a Greater Share)

As OTAs have grown notoriety and trust among travelers, property management companies have struggled to compete, with some practically abandoning the idea of booking via their own site in favor of sites that amount to online travel brochures.

But if property managers ever hope to loosen the stranglehold these third parties have on the booking process, they need to understand how the OTA’s build brand trust.

In retail, the struggle to surmount seemingly unshakable trust in a monster brand is known as “Amazonable.”

If an item or service is “Amazonable,” consumers will quickly order via the shopping and shipping behemoth because of the selection, convenience, and customer service provided.

Companies in retail now strive to be “un-Amazonable,” that is, to provide something the monster online retailer can’t, to have a competing edge.

With HomeAway and Airbnb owning so much of the public’s mind-share when it comes to vacation rentals, property management companies have to strive to do the same on their own sites.

If property management companies don’t take action soon we may come the know the terms “airbnbable” or “un-airbnbable” in the vacation rental sector.

The goal that all property managers should focus on is building a local brand and trusted website that provides a better value proposition than the OTA’s.

Easier said than done, many will say. And yes, admittedly building a well-known, trusted brand takes time and discipline.

However, if property management companies hope to avoid the same fate that the United State’s retail sector is currently experiencing, it’s imperative they invest in drawing customers away from the OTA and back to their own sites for bookings.